PriyoShop and Community Bank Disbursed Bangladesh’s First AI-Powered Credit for MSMEs

-

- - Newsroom -

- Editor --

- ১৫ অক্টোবর, ২০২৫

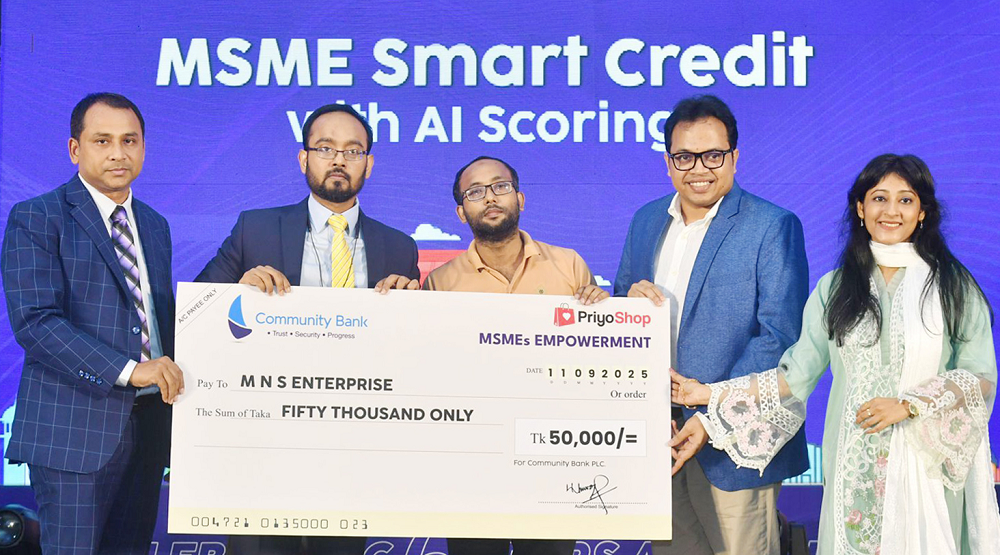

In a landmark move for financial inclusion, PriyoShop, Bangladesh’s leading B2B smart distribution platform, and Community Bank Bangladesh PLC, have jointly disbursed the country’s first-ever AI-powered MSME credit. The historic event was hosted at the InterContinental Hotel Dhaka in the presence of Asikul Alam Khan, Founder and CEO of PriyoShop; Dipty Mandal, Co-Founder and CMO of PriyoShop; and Kimiwa Sadat, Managing Director of Community Bank Bangladesh PLC, alongside senior officials from both organizations.

This pioneering initiative marks the beginning of a new era for the nation’s 5 million underserved MSMEs, empowering small retailers with easier, faster, and more inclusive access to working capital.

With the exclusive partnership with this prominent bank, PriyoShop has introduced the advanced digital eKYC processes, which include the system analyzing three critical dimensions: demographic profiles, purchasing patterns, and psychological indicators. This comprehensive approach enables real-time financial reliability assessments that are both more accurate and more inclusive than conventional banking methods. This initiative is redefining access to finance for MSMEs in Bangladesh, combining human-centered design with cutting-edge AI to unlock economic empowerment at scale for MSMEs. Through intelligent algorithms that analyze alternative data like transaction histories and market trends, the platform delivers authentic credit decisions within minutes. This is about fueling strategic inventory investments, enabling confident market expansion, and accelerating business scaling for a handful of MSMEs in both urban and rural areas.

“MSMEs carry the weight of our economy every day, yet remain underserved. With this first AI-credit disbursement, we are not just unlocking capital; we are unlocking futures,” said Asikul Alam Khan, Founder & CEO of PriyoShop. “Technology, when built with empathy, becomes a tool for dignity, growth, and transformation.”

Echoing the sentiment, Kimiwa Sadat, MD of Community Bank Bangladesh PLC, stated: “This partnership reflects our deep commitment to innovation and financial inclusion. By merging PriyoShop’s cutting-edge AI technology with our financial services, we are creating new pathways for MSME growth and Bangladesh’s economic prosperity.”

Retailer Nazrul Islam, the first recipient of this AI-powered loan, shared his relief: “Getting loans was always a nightmare, too much paperwork, too many rejections. Today, I received credit within minutes. This will help me stock up for the festival season. It feels like the system finally understands us.”

The AI-powered credit program is projected to disburse substantial loan volumes in its first year, directly boosting MSME purchasing power, inventory expansion, and profitability. By accelerating working capital access, the initiative is expected to significantly contribute to Bangladesh’s GDP and strengthen the $200B MSME economy.

This innovation positions PriyoShop at the nexus of fintech, AI, and inclusive commerce demonstrating not only rapid marketplace growth but also deep impact potential. With its exclusive banking partnerships and advanced technology, PriyoShop is building the financial backbone for 5 million MSMEs, ensuring sustainable growth and economic empowerment at scale.

1.gif)

.jpeg)

1.gif)

4.gif)